Pvm Accounting Can Be Fun For Everyone

Pvm Accounting Can Be Fun For Everyone

Blog Article

What Does Pvm Accounting Do?

Table of Contents5 Simple Techniques For Pvm AccountingThe 30-Second Trick For Pvm Accounting6 Simple Techniques For Pvm AccountingAll about Pvm AccountingNot known Incorrect Statements About Pvm Accounting 6 Easy Facts About Pvm Accounting Shown

Supervise and handle the production and authorization of all project-related billings to clients to cultivate good interaction and prevent problems. construction taxes. Ensure that suitable records and documentation are submitted to and are upgraded with the internal revenue service. Guarantee that the accountancy procedure adheres to the law. Apply required construction accounting criteria and treatments to the recording and reporting of building and construction task.Interact with different financing agencies (i.e. Title Firm, Escrow Company) concerning the pay application procedure and requirements needed for settlement. Help with executing and preserving interior financial controls and treatments.

The above declarations are planned to explain the general nature and degree of work being done by individuals assigned to this classification. They are not to be taken as an exhaustive list of duties, obligations, and abilities needed. Employees might be needed to carry out responsibilities outside of their regular obligations once in a while, as required.

Excitement About Pvm Accounting

You will assist support the Accel group to make sure delivery of effective in a timely manner, on budget, jobs. Accel is looking for a Building and construction Accounting professional for the Chicago Workplace. The Construction Accounting professional executes a range of accounting, insurance policy compliance, and job management. Works both individually and within specific departments to preserve monetary documents and make sure that all records are kept current.

Principal responsibilities include, however are not limited to, taking care of all accounting functions of the company in a timely and precise manner and supplying records and timetables to the company's CPA Company in the prep work of all economic declarations. Makes certain that all audit procedures and functions are managed accurately. Responsible for all monetary records, payroll, banking and daily procedure of the audit feature.

Works with Task Managers to prepare and post all monthly billings. Generates month-to-month Task Cost to Date reports and working with PMs to fix up with Task Supervisors' budgets for each project.

The 6-Minute Rule for Pvm Accounting

Effectiveness in Sage 300 Building and Real Estate (previously Sage Timberline Workplace) and Procore construction administration software program a plus. https://pvm-accounting.webflow.io. Have to also excel in other computer system software systems for the preparation of records, spread sheets and various other accountancy evaluation that may be needed by monitoring. Clean-up bookkeeping. Should have solid business abilities and ability to prioritize

They are the monetary custodians that ensure that building jobs remain on budget, abide with tax laws, and preserve economic openness. Construction accountants are not just number crunchers; they are strategic partners in the building procedure. Their main function is to handle the monetary elements of building and construction jobs, making certain that sources are designated successfully and economic threats are decreased.

Pvm Accounting - An Overview

By keeping a limited grip on task finances, accounting professionals help protect against overspending and monetary troubles. Budgeting is a foundation of effective building and construction jobs, and building and construction accountants are crucial in this regard.

Construction accountants are skilled in these guidelines and make certain that the task complies with all tax demands. To stand out in the duty of a building and construction accounting professional, people require a strong educational foundation in bookkeeping and money.

Furthermore, accreditations such as Certified Public Accounting Professional (CERTIFIED PUBLIC ACCOUNTANT) or Licensed Building Industry Financial Specialist (CCIFP) are highly pertained to in the market. Building projects often entail limited due dates, changing laws, and unforeseen expenses.

9 Easy Facts About Pvm Accounting Described

Specialist qualifications like certified public accountant or CCIFP are additionally extremely suggested to demonstrate proficiency in construction accounting. Ans: Construction accounting professionals develop and keep an eye on budget plans, identifying cost-saving chances and guaranteeing that the project remains within budget plan. They also track expenditures and forecast financial demands to stop overspending. Ans: Yes, construction accounting professionals handle tax obligation conformity for construction tasks.

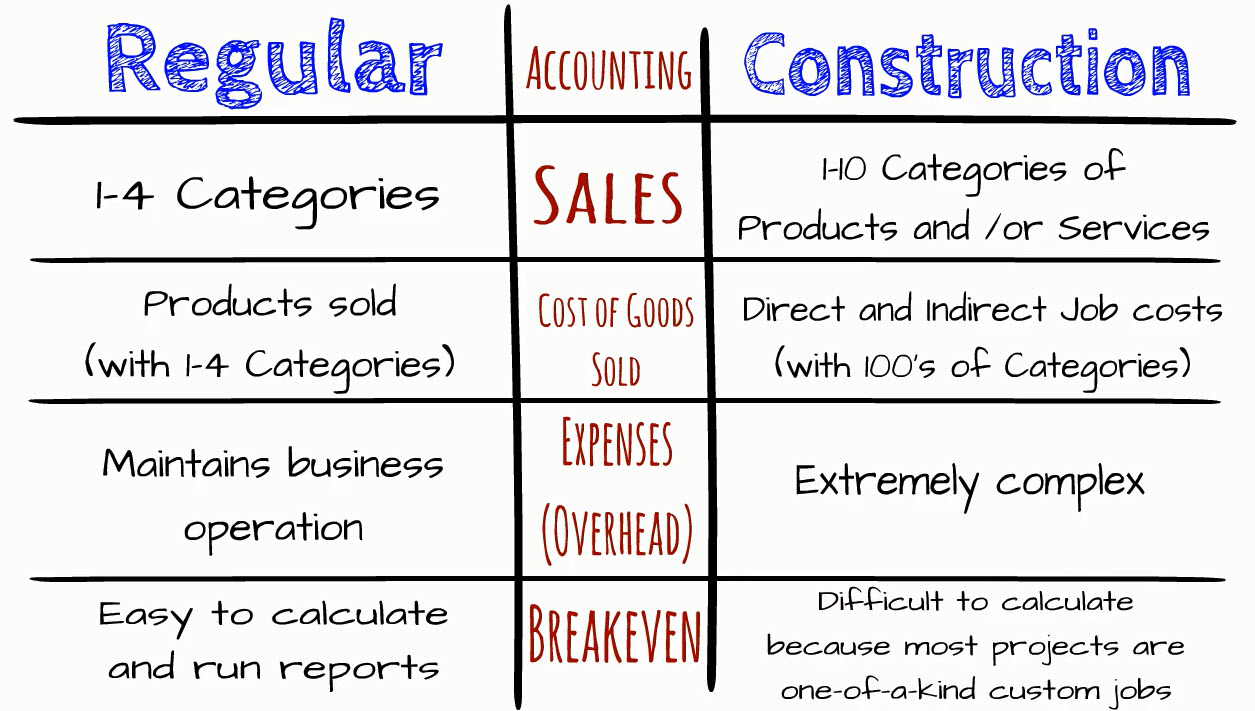

Introduction to Building Accounting By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building firms have to make hard options amongst numerous monetary choices, like bidding on one task over another, choosing funding for materials or devices, or establishing a project's revenue margin. In addition to that, construction is a notoriously unstable sector with a high failure rate, sluggish time to payment, and inconsistent money flow.

Manufacturing involves repeated procedures with conveniently recognizable expenses. Production calls for different processes, products, and devices with differing costs. Each job takes area in a new place with differing site conditions and special challenges.

The Main Principles Of Pvm Accounting

Resilient partnerships with suppliers reduce negotiations and improve efficiency. Inconsistent. Frequent use of different specialty professionals and providers affects efficiency and cash flow. No retainage. Payment gets here in complete or with normal settlements for the complete contract amount. Retainage. Some portion of settlement might be held back till task completion even when the contractor's work is completed.

Routine production and temporary agreements result in manageable capital cycles. Uneven. Retainage, sluggish payments, and high in advance costs bring about long, irregular cash money flow cycles - Clean-up bookkeeping. While traditional manufacturers have the benefit of controlled atmospheres and optimized manufacturing processes, construction firms need to continuously adjust to each brand-new project. Also rather repeatable jobs call for modifications as Web Site a result of site problems and other aspects.

Report this page